⌛ Limited Time to Act Before Lenders Adjust

🔥 This offer expires in:

844-611-Debt (3328)

The HB-700 Compliance Consultation:

For Business Owners With MCA Debt

Leverage the new law to cut payments, settle MCA debt, and protect your business.

House Bills Give Small Business New Borrower Protections

Without filing bankruptcy or taking on more predatory debt, House Bills give you new leverage against MCA lenders. Learn how this law can reduce your payments, protect your cash flow, and keep your business alive.

The MCA Trap: What Business Owners Face

Daily / weekly withdrawals

Ballooning balances

UCC liens freezing accounts

Hidden fees & aggressive collections

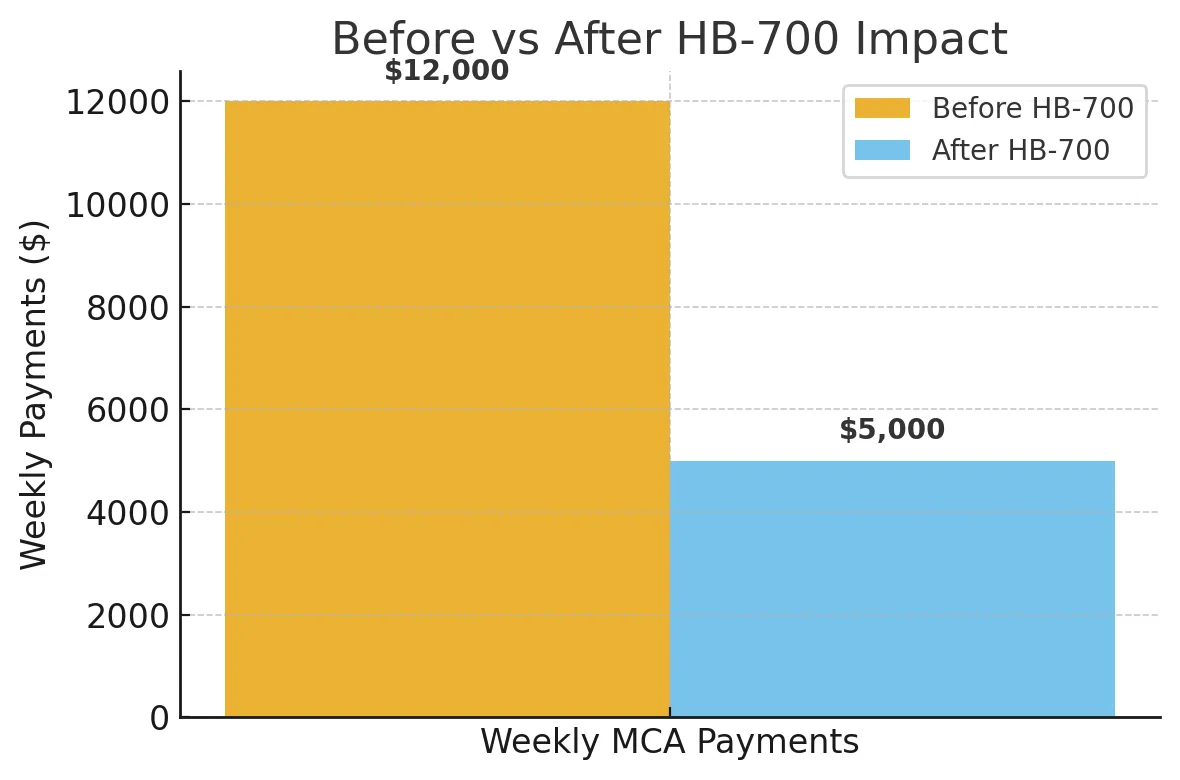

Real Texas Business, Real Results

JAMES WILSON

Retail Store Owner, Dad of 2

"Before HB-700, I was paying over $12,000 a week in MCA payments across three contracts. It felt like every dollar of revenue was being drained before I could even make payroll. After my consultation, I learned my contracts weren’t compliant with the new Texas law. Within months, my payments dropped to just $5,000 a week. I can finally breathe again, cover expenses, and focus on growing my business instead of just surviving."

Stop the Daily MCA Bleed

Daily ACH withdrawals bleed your cash flow dry faster than you can make sales. Most business owners think they’re just “riding it out” — but the truth? That $50K advance has already snowballed into $87K.

This guide shows how owners stop the drain, freeze collections, and buy back breathing room.

Unlock Legal Power Moves

Here’s the truth MCA lenders don’t want you to know: they’re counting on you not knowing your rights. This guide opens up the same legal pressure points that top businesses use to cut massive MCA debts — sometimes by 40%, 60%, even 80% — without bankruptcy. You don’t need millions. You just need the right moves.

Slash Stacked Loan Chaos

Stacked MCAs are the lenders’ jackpot… and your nightmare. While you juggle 3–5 advances at once, they’re multiplying interest and fees at rates that’d make loan sharks blush — sometimes 820% APR. We’ll show how business owners flip the script, slash stacked payments, and finally get lenders off their back.

Freedom In 5 Minutes

Getting out of MCA hell isn’t complicated. In fact, most of the work is just sending one strategic letter and following a simple plan.

We’ll show you how business owners are reclaiming their time, their revenue, and their sanity — often with less than 5 minutes of action a week once the process starts.

Don’t Wait Until Lenders Adjust Their Contracts!

Unlock Your House Bill Case Review

This isn’t theory — it’s the law. Starting September 1, 2025, Texas HB-700 (HB 700) forces MCA lenders to disclose the real cost of financing and provide clear repayment terms. That means you may now have legal leverage to reduce payments, challenge violations, and finally protect your business cash flow.

Over 1,200 business owners have already fought back against MCA lenders with our help. You can too — with no upfront fees.

TAKE BACK CONTROL

© Copyright 2025 - Debt Consultants Group - All Rights Reserved

Disclaimer: Debt Consultants Group does not provide loans or merchant cash advances. We provide educational resources.

Debt Consultants Group is not a lender and does not offer loans or credit cards. We provide educational resources and consulting services to help business owners better understand financing contracts and explore strategies for managing cash flow. This is for informational purposes only and should not be considered financial, investment, or legal advice. The content is based on research and experience and is intended to share general concepts and strategies. Individual circumstances vary, so you should consult a qualified financial advisor before making any financial decisions. We do not guarantee specific results, and all financial choices carry risk. Examples, figures, or scenarios provided may be illustrative or modified. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.